Condo Insurance in and around Auburn

Condo unitowners of Auburn, State Farm has you covered.

Quality coverage for your condo and belongings inside

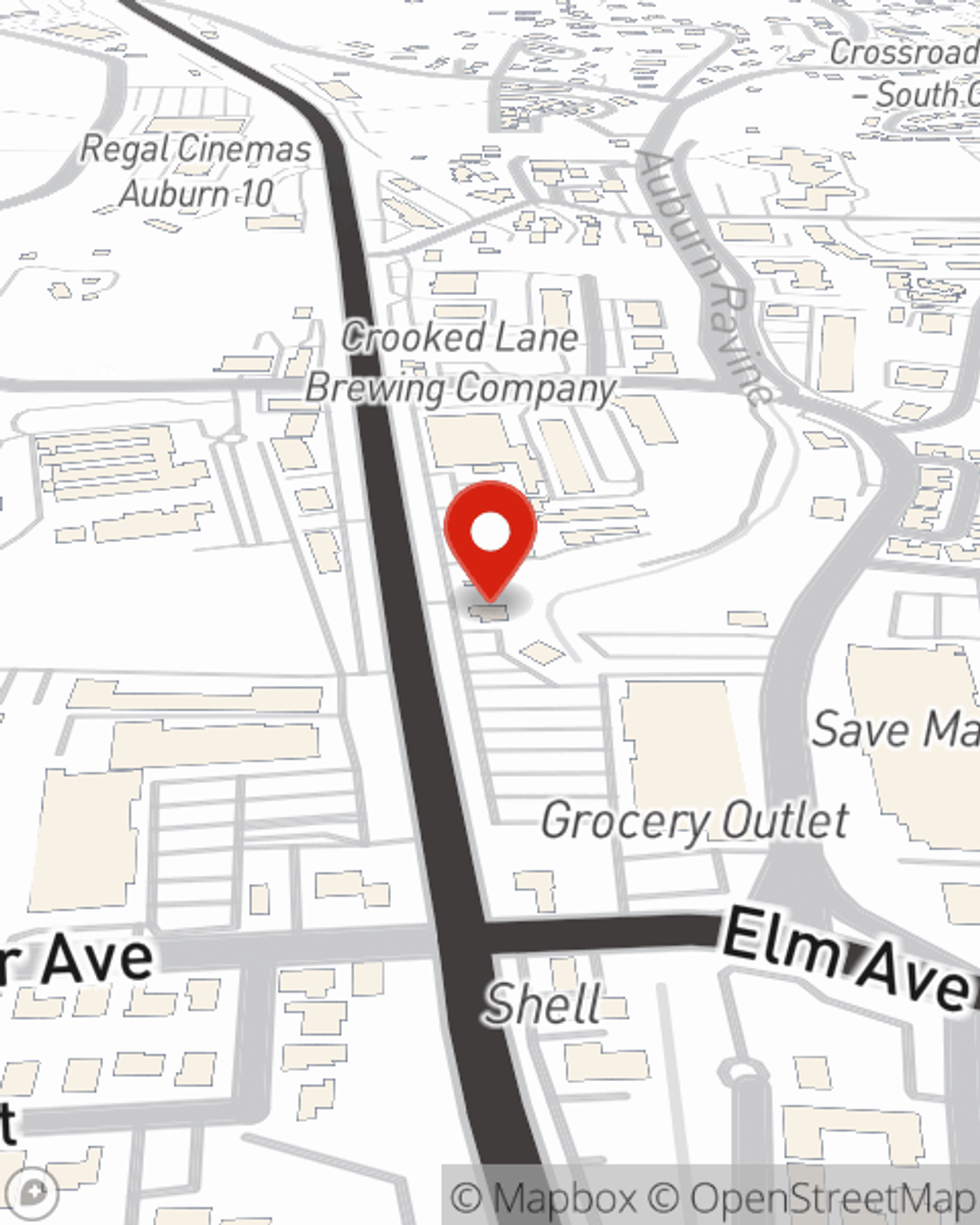

- Auburn

Home Is Where Your Condo Is

Your condo is your home. When you want to recharge, relax and wind down, that's where you want to be with your favorite people.

Condo unitowners of Auburn, State Farm has you covered.

Quality coverage for your condo and belongings inside

Condo Unitowners Insurance You Can Count On

That’s why you need State Farm Condo Unitowners Insurance. Agent Ralph Smith can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Ralph Smith, with a no-nonsense experience to get high-quality coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent Ralph Smith can help you file your claim whenever the going gets tough. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Don’t let fears about your condo keep you up at night! Get in touch with State Farm Agent Ralph Smith today and find out how you can benefit from State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Ralph at (530) 885-8652 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Ralph Smith

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.