Business Insurance in and around Auburn

Get your Auburn business covered, right here!

Almost 100 years of helping small businesses

- Auburn

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes accidents like an employee getting hurt can happen on your business's property.

Get your Auburn business covered, right here!

Almost 100 years of helping small businesses

Surprisingly Great Insurance

With options like errors and omissions liability, worker's compensation for your employees, business continuity plans, and more, having quality insurance can help you and your small business be prepared. State Farm agent Ralph Smith is here to help you customize your policy and can assist you in submitting a claim when the unexpected does happen.

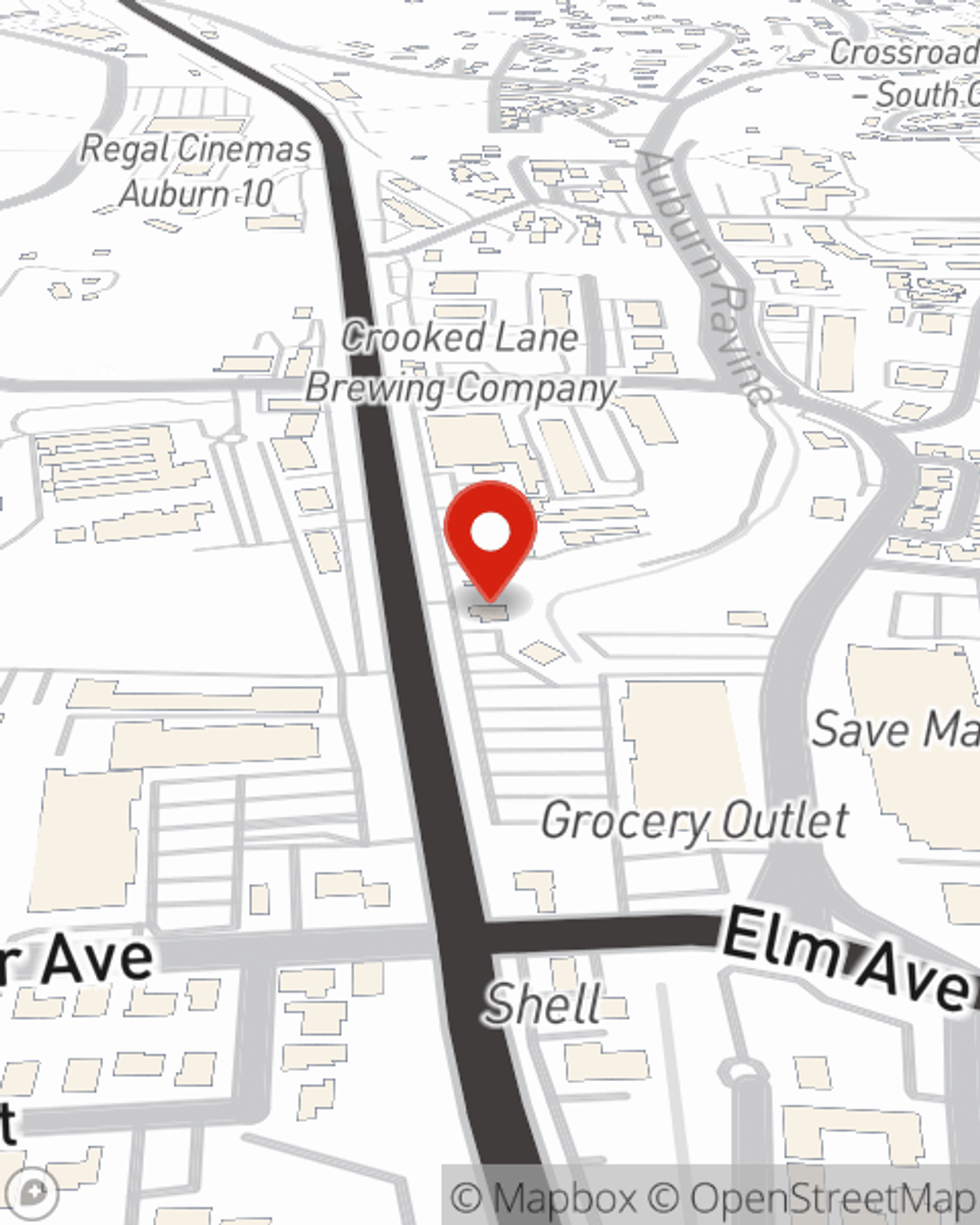

Do what's right for your business, your employees, and your customers by visiting State Farm agent Ralph Smith today to discover your business insurance options!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Ralph Smith

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.